Industries We Serve

At Futuro, Our experts deliver tailored solutions, multi-state compliance, and industry-specific support you can rely on.

We provide expert sales tax solutions tailored to the unique needs of each industry—helping businesses stay compliant, reduce risk, and grow with confidence.

Packages start at $1,200/yr

Industries We Serve

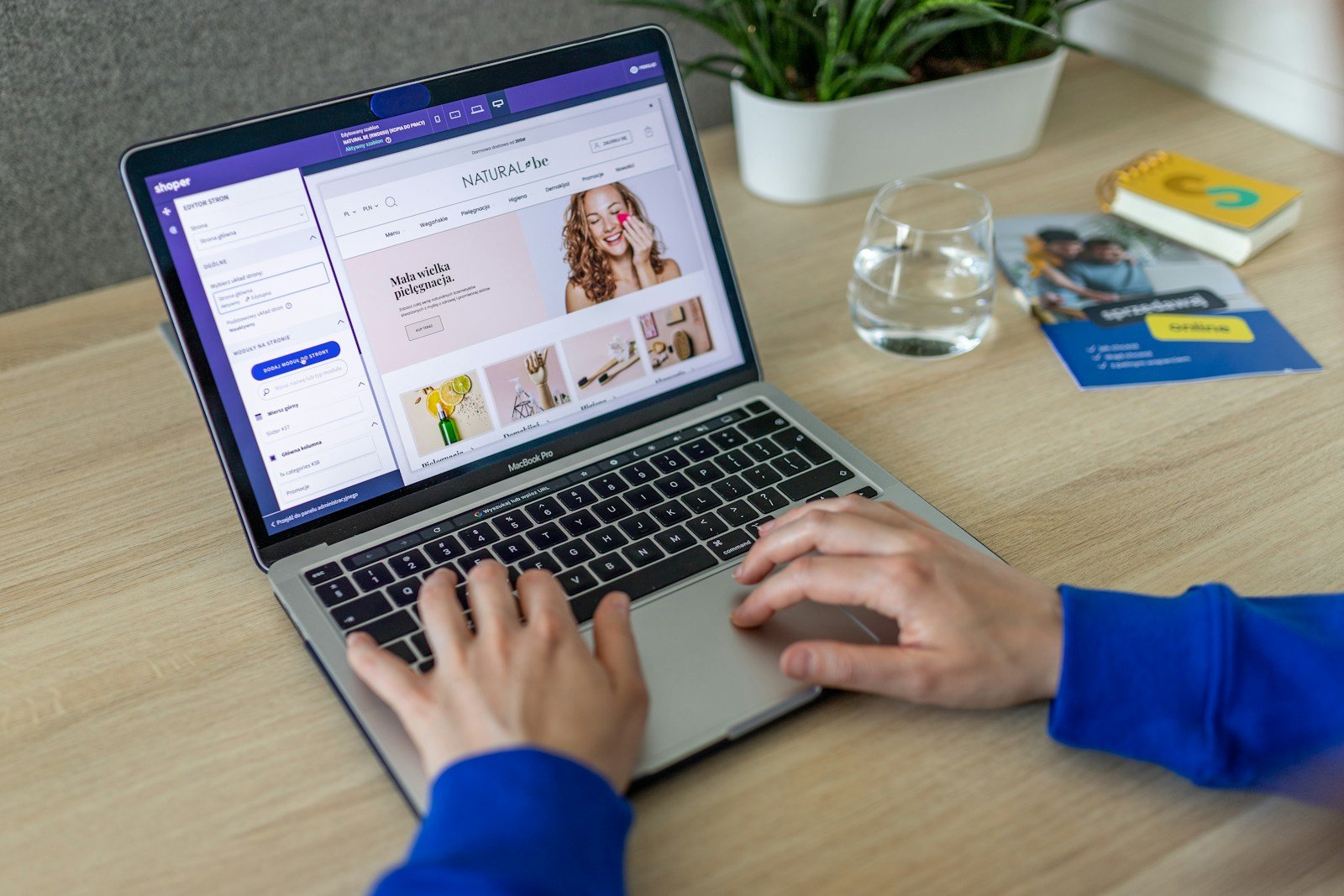

Ecommerce & Online Retailers

Selling through platforms like Amazon, Shopify, or your own website? We help online sellers stay compliant across states with economic nexus laws and marketplace facilitator rules.

Common Issue:

Determining where you owe tax and whether the platform is collecting it for you.

Software & SaaS Companies

We work with SaaS providers, app developers, and digital product companies to identify tax obligations in complex and inconsistent state tax environments.

Common Issue:

Understanding which states tax SaaS and how digital services are classified.

Manufacturers & Wholesalers

Our team assists manufacturers and wholesalers in managing exemption certificates, property tax, and multi-state filings—ensuring smooth operations across the supply chain.

Common Issue:

Validating and maintaining exemption certificates to avoid audit penalties.

Service-Based Businesses

We help service providers—from consultants to repair specialists—understand which services are taxable, where they’re exempt, and how to stay compliant.

Common Issue:

Misclassifying taxable services, especially for digital or labor-based offerings.

Food & Beverage

We guide restaurants, food delivery brands, and packaged goods businesses through complex taxability rules across states and platforms.

Common Issue:

Knowing the difference between taxable prepared food and exempt grocery items.

Construction

From material taxability to contractor compliance, we support construction firms in applying sales and use tax correctly in every state they operate.

Common Issue:

Confusion over use tax obligations in lump-sum vs. time-and-materials contracts.

FAQ Question

Your questions, answered

01.

Sales tax is a state-imposed tax collected by sellers on the sale of taxable goods and services.

Use tax applies when a business purchases taxable items without paying sales tax (e.g., from an out-of-state vendor) and uses them in a state that requires the tax. Businesses are typically responsible for self-assessing and remitting use tax if it wasn’t collected at the time of purchase.

02.

Non-compliance can lead to serious consequences, including:

Penalties and interest on unpaid taxes

Costly state audits

Damage to your reputation and business credibility

Retroactive tax liabilities (going back several years)

Ineligibility for voluntary disclosure programs or amnesty

03.

Nexus is a legal connection between a business and a state that creates a sales tax obligation.

Physical Nexus: Having offices, employees, inventory, or warehouses in a state.

Economic Nexus: Reaching a threshold of sales or transactions in a state (e.g., $100,000 or 200 transactions per year), even without physical presence.

Once nexus is established, the business is required to collect and remit sales tax in that state.

04.

Sales tax laws vary by state and change frequently. A dedicated sales tax consulting firm like Futuro provides:

Expert interpretation of complex state rules

Accurate nexus and taxability analysis

Multi-state compliance setup

Audit defense and risk mitigation

Strategic, scalable solutions without the high cost of in-house tax teams

With expert guidance, you save time, reduce risk, and avoid costly errors.